Callia market framework and grid operator coordination scheme

The main objectives of the Callia market framework is to position a market-based decision-making platform that allows to:

- Take into account medium, high and very high voltage level grid constraints and losses, allowing for solutions that are grid-aware and favor solutions where flexibility is used locally.

- Take into account the flexibility of energy-constrained assets.

- Make decisions that respect the integrity and responsibility of system operators.

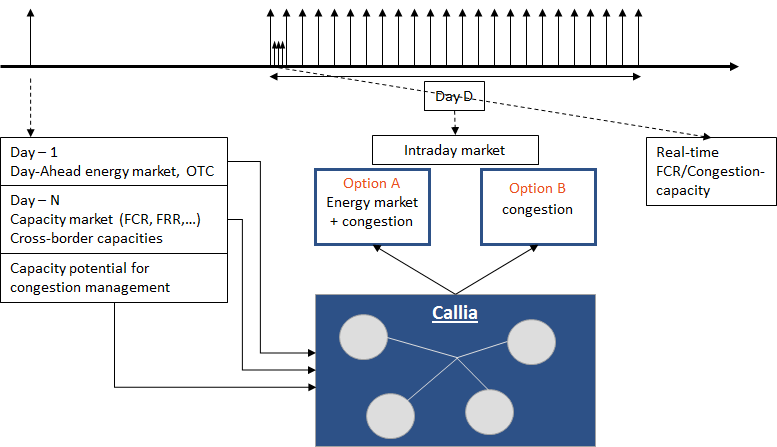

In order to position the Callia framework in the existing landscape of the energy economy, we consider a set of services in the power system that are deemed relevant. We distinguish between Day-N decisions (long term trading, esp. on capacity markets like FCR or potential congestion markets), Day-1 decisions (schedules and allocations), Intraday decisions and Real-time decisions. As shown in the overview diagram in Fig. 1, the Callia market framework can be aligned with intraday decisions in two different ways. Option A is driven by energy trading and finding an energy balance at the minimum cost for society, taking grid constraints into account to prevent congestion issues. Option B is driven by congestion issues, where congestion mitigation could be purchased. The Callia market will work as a predictive decision-making process which optimizes over a receding horizon of several hours where only the first time slot is considered binding.

Figure 1: Embedding of Callia market in existing system

The Callia framework is basically a market platform which acts as an interface between market/system operators and flexibility providers like aggregators in terms of both, demand and production, non-flexible demand and production and a set of grid-constraints. Flexibility could be provided in products like tank bids, traces or smart block orders. In comparison to existing markets, these products must be extended by a locality tag to allow for matching the efficacy of flexibility offers to local grid constraints. The grid constraints are provided by grid operators to the market via the market – grid operator – interface maintaining data security of sensitive grid information. Within the interface, the calculations for clearing the Callia market are performed. This setup is illustrated in Fig. 2. It is to be mentioned that this illustration is related to Option A, where the intraday market is associated with the Callia flexibility market platform. For option B, the intraday market would be placed outside of the Callia market platform.

Figure 2: Callia market platform – Interface for connecting market and grid operator

Problems related to incorporating a number of decentralized flexibility assets, taking transmission and distribution grid constraints into account and finding solutions at the most local level possible were faced. To solve this, the ‘master’-market clearing problem (or central clearing) considered at system level is decomposed into a set of ‘sub’-problems (or local clearings), each constituting a part of the master problem. The ‘sub’- problems need to interact amongst themselves as also with the master problem via shadow prices to make sure one optimal solution at the system level is obtained. The main advantages are scalability and the possibility to map the sub-problems onto the system operators, who could also host these sub calculations while the TSO could host the central calculations, as shown in Fig. 3. This also goes hand in hand with new interaction schemes for grid operators, where the present mind-set of top-down and bottom-up must be intensified and extended horizontally and by implementing the full flexibility stack as already shown in CALLIA IN A NUTSHELL

Figure 3: Exemplary Callia conception of a scheme for decomposing a global problem to a set of local clearings which are connected via a central synchronization clearing for application in power systems and markets

For further information on the use cases, the used grid models, functionality of clearing algorithms and the platform please proceed to the deliverable reports in section: